Table Of Content

The figure is on a par with the 7.1% recorded in the 12 months to November last year, but the property portal warned that momentum in the housing market is “falling away rapidly”. “While financial market conditions have settled, mortgage rates are taking longer to normalise and activity in the housing market has shown few signs of recovery. The number of prospective buyers making enquiries with estate agents listed on the portal also rose by 4% compared to the same period in pre-Covid 2019. And it is up by 55% compared with the two weeks before Christmas, as sellers test the cooling property market. The figures point to a cooling of the housing market at the end of last year in the wake of the Liz Truss/Kwasi Kwarteng mini-Budget in September, which rocked market confidence and led to an increase in mortgage rates. “There has been a clear shift towards flats as the early buyers focus on value-for-money and adjust expectations given the hit to buying power from higher mortgage rates.

June 14: Cost Of Renting Soars To Record High

Levy stays up-to-date on all the latest tour announcements from your favorite musical artists and comedians, as well as Broadway openings, sporting events and more live shows – and finds great ticket prices online. Since he started his tenure at the Post in 2022, Levy has reviewed Bruce Springsteen and interviewed Melissa Villaseñor of SNL fame, to name a few. While it’s not the case for her U.S. and Canada gigs — where prices have mostly stayed flat or slowly risen — we’d argue it might be in your best interest to book tickets to an overseas ‘Eras Tour’ concert given this cooldown. I’ve been writing for a broad array of online publications for four years, always aiming to make important insights accessible.

Climbing costs

Zoopla said buyer demand remains strong, up 20.5% compared with the 2020 average. The figures also showed that competition among buyers intensified through the second half of 2020 and into 2021. The UK property market faces an “acute shortage” of homes for sale, after a record number of transactions to beat changes to the temporary stamp duty regime used up available stock, according to the property portal Zoopla. The bank says the average UK property price stands at £262,954, which is a record high. Demand has been fuelled in recent months by changes to stamp duty rules, including the ending of the tax holiday in Wales and the tapering of relief in England.

A Realtor.com coordinator will connect you with a local agent in minutes

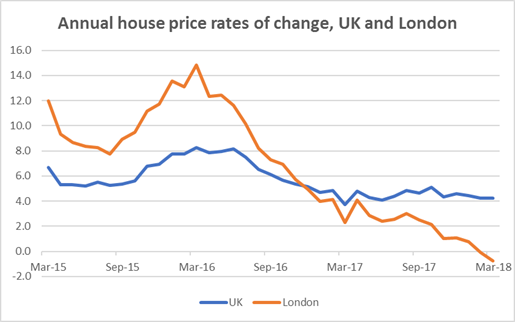

London’s average house prices remain the most expensive of any region in the UK, with an average price of £528,000 in June 2023. “Prices are falling more in southern England where higher mortgage rates have priced more people out of the housing market, weakening demand. While UK house prices are 0.1% higher over the year, it is the number of sales that have been hit hardest by higher borrowing costs, especially amongst mortgage reliant buyers. Higher mortgage rates and the rising cost of living have put a dampener on house price inflation over the past 12 months. Data from the property portal showed that average house prices in April hit £250,200, marking an annual inflation rate of 8.4% compared to 9% in March.

The ONS said Scotland’s annual house price inflation had been slowing since April last year, reaching 5.5% in the year to November 2022, down from 14.2% in the year to April 2022. Nationwide building society’s latest house price index, out today, shows the annual rate of price growth slowing from 2.8% in December 2022 to 1.1% in January 2023. Halifax, Britain’s biggest mortgage lender, says stability returned to the UK housing market in January after falls in the value of a typical property in the closing months of 2022. Average UK house prices stood at £294,000 in December 2022, according to the latest figures from the Office of National Statistics (ONS) – £26,000 higher than the same month a year earlier, writes Andrew Michael. Demand is also stronger than many expected after a year of interest rate hikes, soaring living costs and economic turbulence.

The ONS’ provisional estimate for the average UK house price was £288,000 for October 2023 – £3,000 lower than 12 months previously. Halifax’s more positive historic housing market data comes as figures from online property portal Rightmove found that a record number of homeowners put their property up for sale on Boxing Day. The 26% uplift on 2022’s number suggests more people are now considering a house move in 2024. In Scotland, however, the average price increased by 3.3% over the 12 months to December 2023, having risen by 1.1% in November. The average house price was £190,000 in December, £6,000 higher than 12 months previously. £534,000, twice the UK average house price which now stands at £263,600, and prices have fallen annually by 0.8% (a more modest fall than other regions in the south).

“Affordability remains stretched for those relying on mortgages to fund their purchases but lenders continue to reduce their pricing which over time will help ease the situation. Northern Ireland showed greatest resilience in difficult market conditions, reporting a 1.8% year-on-year fall in prices. However, September’s fall was less than that of August, when prices dropped by 1.8%, suggesting that the pace of price falls could be slowing down. London, the South West and the East of England have suffered the biggest falls for the year, on average, with falls of 2.1%, 2.1% and 1.9% respectively.

Rightmove data shows the number of agreed sales is 15% lower than in 2019, when market conditions were more ‘normal’ before the Covid pandemic. The number of first-time buyers enquiring about properties for sale is at 1% above 2019 levels. In recent months, buyer demand has slumped in response to sky-high mortgage rates and persistently high living costs. “It may also come as some relief to those looking to get onto the property ladder. Income growth has remained strong over recent months, which has seen the house price to income ratio for first-time buyers fall from a peak of 5.8 in June last year to now 5.1.

This bounce is likely due to pent-up demand among potential buyers, combined with falling mortgage rates since the end of last year, which have improved affordability. The average house price in England decreased by 2.1% over the 12 months to December 2023, up from a decrease of 3.0% in the year to November. The average price was £302,000 in December 2023, £7,000 lower than a year previously. All 11 regions across the UK saw a monthly rise in asking prices in February, with seven regions also posting annual asking price increases. However, the East Midlands, East of England, South East and South West are still reporting asking prices less than those recorded a year ago.

Should I Buy A House Now Or Wait? Is It A Good Time? - Bankrate.com

Should I Buy A House Now Or Wait? Is It A Good Time?.

Posted: Thu, 25 Apr 2024 13:41:15 GMT [source]

However, the market remains ‘price sensitive’, with the time it takes to find a buyer more than two weeks longer than in February last year. The average time to sell is also at its slowest since 2015 (excluding the initial months of the pandemic lockdown). While prices were down by 0.2% in March itself, prices are higher than a year ago, showing a modest recovery for the market. In English regionals, annual inflation was highest in the North East, where prices rose by 2.9% in the 12 months to February.

In England, house prices rose by 6% to an average of £308,000 in the year to February. This contrasted with a double-digit rise of 10.2% recorded in Northern Ireland, taking prices to an average of £175,000. Average house prices fell by 0.3% in April, according to Halifax, after three consecutive months of growth up to March. But Britain’s biggest mortgage lender says an increase in approvals points to growing market stability, writes Jo Thornhill.

No comments:

Post a Comment